These market corrections always feel so intense and dire while we are going through them, leading to a number of investors deciding to sell their stocks from the fear of losing even more money as the days go by.

In the current market sell-off, I have had a number of conversations with friends and families who are wondering what they should be doing with their investments and portfolios now.

What you should not be doing

Panicking! – take control of your fears

If you are looking to build sustainable wealth, you can not afford to be making decisions based on emotions. You need to be able to separate your emotions from your investment decision making in order to successfully grow your wealth. And, if you feel that you have not mastered this skill, then seek the help of an investment advisor or professional to help guide you through your investment decision making.

What you should be doing

Re-affirm your investment horizon

I am a strong advocate for long term investment horizons. i.e. a minimum of 5 years’ investment horizon. Actually, the longer the better! (We will chat more about this in another write up)

if you are looking to make a quick buck, then this is definitely not the time to be investing in the stock market, because history has shown that attempting to time the bottom of the market is near impossible and only happens out of luck. You would probably be better off playing the Lotto.

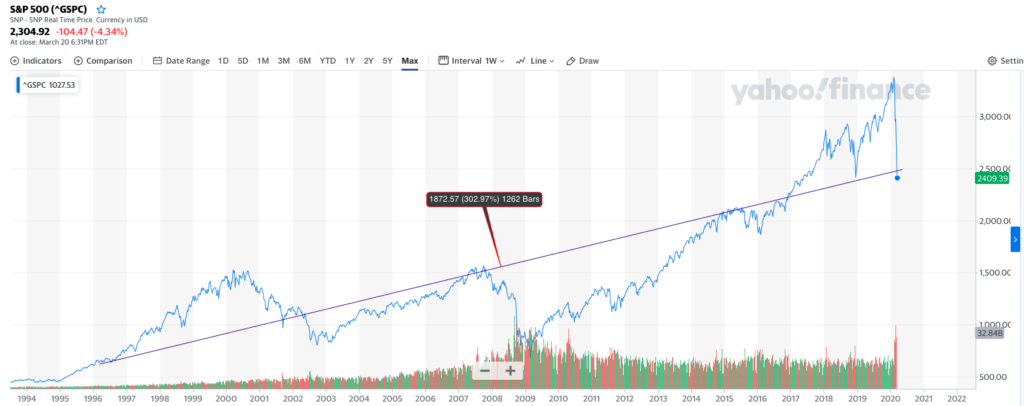

On the flip side, if you are in for the long run, remind yourself that markets go up and down all the time to different degrees, but in the long run, the stock market generally maintains an upward trend. For example, the S&P 500 has seen some significant market sell-offs in its trading history but still maintains an upward trend in the long term.

Take advantage of opportunities that present

A bear market brings about some great opportunities to invest in solid companies that are trading at a discount due to the sell-offs. Stick to large companies with strong balance sheets. Those that have been around for a very long time.

If you already have a few of these companies in your portfolio, now may be the time to buy some more. The effect of this is that the average cost of the shares you have purchased will be lower than if you took no action at all during a market sell-off.

Also, your lower average cost would also mean you can benefit more when the market rebounds, and this is something we know for certain will happen at some point in the coming months/years.

Are you a new investor with a lot of cash?

You may have just come into some inheritance, trust fund, or you are a new immigrant who has moved countries with a lot of cash to invest. If this is you, then you are in a sweet spot and the market pullback will be a great opportunity for you to get into some quality stocks at a discount, as long as you are investing for the long term.

Diversify your portfolio

Diversifying your investments should always be at the forefront of your investment decisions. As the saying goes, “don’t put all your eggs in one basket”.

The type of investments you have should be aligned with your age and risk tolerance. The general rule is that as you grow older and closer to retirement, you should have less of your investments in stocks and more in investments like treasury bills, and bonds. The split between all these types of investments is referred to as asset allocation and this needs to be rebalanced occasionally as you grow older and your risk tolerance changes.

There are a few investment options out there that would do a portfolio rebalancing for you automatically without you having to do very much. An example of this is :xxxxxx

Cut down on your disposable spending

This is the time to cut out and significantly reduce your spending on “nice to have’s”. It is common knowledge that significant market sell-offs often leads to an increase in unemployment figures, as companies try to stay afloat by cutting costs. This is particularly more important if employment income is your only source of income, or if you are in a single income family.